Need Expert Financial Advice?

or Call Us at: +852 3728 0490

Introduction

The term Asset Management is most commonly used in the financial world to describe people and companies that manage investments on behalf of others. Investors are currently facing unprecedented challenges in today’s global markets. Finding answers can be hard. In a busy world finding the right amount of time to carry out appropriate due diligence and the required continuous monitoring can be difficult for most individual investors. At Expat Financial we are able to help to build portfolios for clients dependent upon their specific risk profile and time they are prepared to invest for.

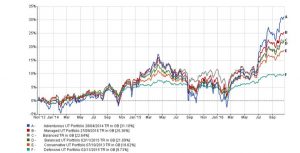

Below show examples of how certain risk weighted portfolios have appreciated over the past 3 years – posting returns significantly better than cash (click on the graph for a larger view).

Things to consider

– Flexibility: Markets are always in a certain state of flux – try to ensure you have maximum flexibility on your investments, as what may be right today, may not necessarily be the best place to keep your money tomorrow.

– Investment costs: There will always be a cost to invest, even hoarding money in the bank has a missed ‘opportunity’ cost. Ensure you always have complete transparency on fees- Expat Financial can help you understand if there are any hidden costs with your investment.

Summary

At Expat Financial we recognise that no single investment house has a monopoly on investment expertise, and we do not employ in-house investment managers. Instead we help clients carefully select a robust, diversified investment portfolio that spreads risk across various asset classes, geographies and industry sectors, make contact today for a zero commitment discussion about how we can help you grow your finances and wealth.

Get Personalised Investment Advice

Additional Information Resources

Additional information resources are available by clicking on the links below:

You can also view information related to your particular stage of life: